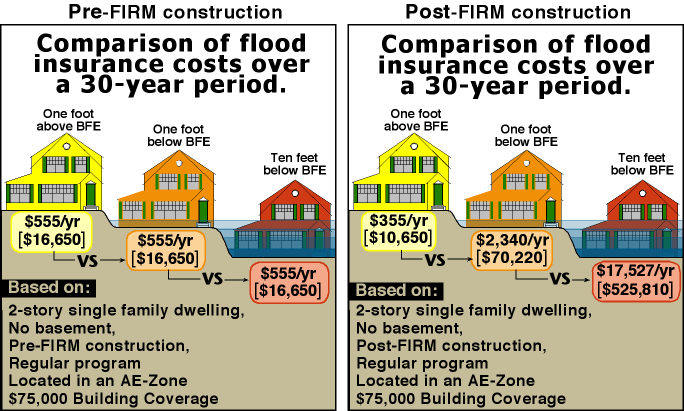

In the center of the map, it will indicate what zone the property is in. Simply input the address and a map will display. You can look up a property address using this FEMA Flood Zone Website. A Coastal Area, and insurance under the National Flood Insurance Program (NFIP) is not available in the communityĪccording to the FHA, flood insurance coverage must be maintained on the home for at least the amount of the remaining mortgage OR the replacement cost of the home (whichever is lowest).* Working with a lender yet? If so, we likely can beat the rate through our network of FHA lenders without pulling your credit report.Ĭlick to get a low FHA rate quote Existing Homes – FHA Rules for Homes in a Flood Zoneįlood Insurance Requirements for Existing Homes – A property is not eligible for an FHA insured mortgage if it is located in the following areas: You can read about the FHA Flood Guidelines beginning with row 358 in the Section 4000.1 of the Hud Handbook. However, in some flood areas an FHA loan can be obtained to purchase a home there. There are certain types of Flood Hazard Areas that simply are not eligible for an FHA loan. You can get an FHA loan but the FHA has rules for obtaining a mortgage for homes that are in a flood zone. However, you also need to determine whether you are able to finance that property with an FHA loan. If you plan to have a mortgage on the home in a flood zone, you will likely need flood insurance. Call your agent or broker immediately if you suffer flood damage.Many consumers are shopping for a home that may be in a FEMA designated flood zone. It is helpful to have photos and receipts of your items as well. Keep your flood policy and an itemized list of furnishings, clothing, and valuables in a safe place, such as a waterproof and fireproof safe. Contact your insurance agent to start a policy today. Typically, there is a 30-day waiting period before a flood insurance policy becomes effective. You must have an active flood insurance policy at the time of the flooding event to be eligible for any disaster relief or FEMA grant programs. When Should Flood Insurance be Purchased? The maximum policy amount available from the federal government for a single-family residence is $250,000 on the building and $100,000 for contents. Facts show those insured in Zones X, B and C file more than 20 percent of all flood insurance claims through the National Flood Insurance Program (NFIP) and receive one-third of federal disaster assistance for flooding. For properties in Flood Zones X (low to moderate risk area), flood insurance is highly recommended as floods do not respect their boundaries. Properties in Flood Zone AE (high risk area) are required to carry flood insurance if they have a federally backed mortgage. Costs vary depending on how much insurance is purchased, what’s covered and the property’s flood risk.įlood Insurance Requirements and Benefits

All policy types provide coverage for buildings and contents. To protect investments, flood insurance is available to homeowners, renters, and commercial owners/renters. Geographically, our city lies at or below sea-level, which makes properties within the city prone to hurricanes, heavy rains, and flooding. Flood insurance is a wise investment for anyone in Gretna.

0 kommentar(er)

0 kommentar(er)